Difference between revisions of "Adjustments"

| Line 104: | Line 104: | ||

===Example - Need to Adjust an employee's Pay after processing pays - AU=== | ===Example - Need to Adjust an employee's Pay after processing pays - AU=== | ||

| + | |||

| Line 111: | Line 112: | ||

From here change the date to the relevant period ending - ie the period ending that you want to adjust (this is important as by choosing the same period ending then the system can calculate what was paid against what should have been and then adjust all of the relevant items such as tax, leave, on costs etc accordingly). | From here change the date to the relevant period ending - ie the period ending that you want to adjust (this is important as by choosing the same period ending then the system can calculate what was paid against what should have been and then adjust all of the relevant items such as tax, leave, on costs etc accordingly). | ||

| + | |||

[[File:Pay_Adjustment_AU.png|800px]] | [[File:Pay_Adjustment_AU.png|800px]] | ||

| Line 130: | Line 132: | ||

===Example - Need to Adjust an employee's Tax after processing pays NZ=== | ===Example - Need to Adjust an employee's Tax after processing pays NZ=== | ||

| + | |||

'''At this stage, manual adjustments are only available in NZ - we are soon adding a similar adjustment batch process to AU.''' | '''At this stage, manual adjustments are only available in NZ - we are soon adding a similar adjustment batch process to AU.''' | ||

Latest revision as of 00:00, 28 May 2019

Contents

About

This page discusses some of the ways that you are able to make an adjustment to pay and invoicing data that has been entered and/or processed in PinvoiceR.

Making adjustments before batches are written to the General Ledger

Editing Transaction Rows

The easiest way to make an adjustment to a pay and/or a charge is if you have entered the hours from an order is to edit hours from the orders screen.

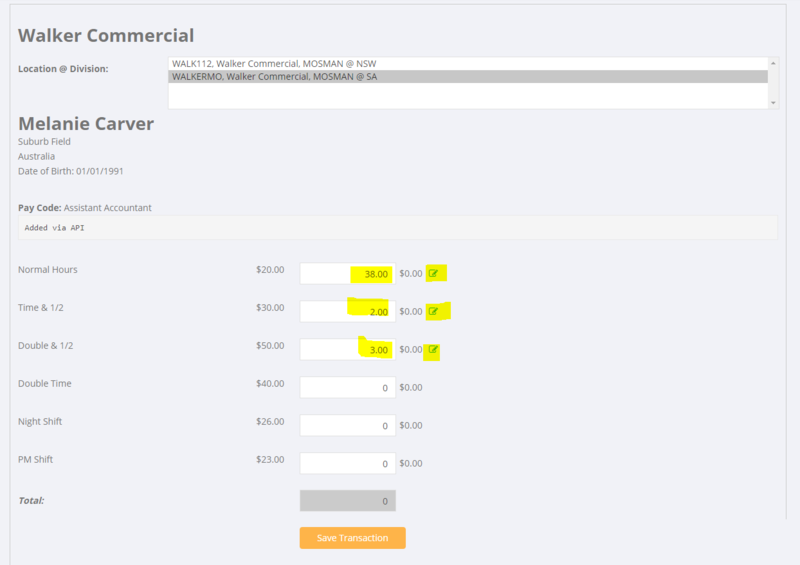

To do this - go to the Orders screen and click on the name of the person that you want to edit - ie they will have already had hours entered for them. On the following screen click the Next button. This will bring you to a summary of the hours that have been previously entered.

Here you can adjust the quantities in the relevant pay code items & days - eg

- to change 38 hours to 36 hours, type in 36

- to change 38 hours to 0 hours, type in 0

- to change 0 hours to 5 hours, type in 5

- to change the transaction type from NORMAL to DO NOT CHARGE CLIENT will only pay the employee

Make the changes you need and click the Save Transaction button.

Note: - the pencil note icon next to the hours is a link to the Edit Pay Rows for that transaction - see next article for more info.

Edit Pay Rows

Another method to edit transactions before they are posted to the general ledger is to us the Edit Pay Rows (or also the Edit Invoice Rows) function. In essence they are the same process but if you have posted a batch you are still able to make some adjustments to the invoice with the Edit Invoice Rows function - prior to creating the invoice).

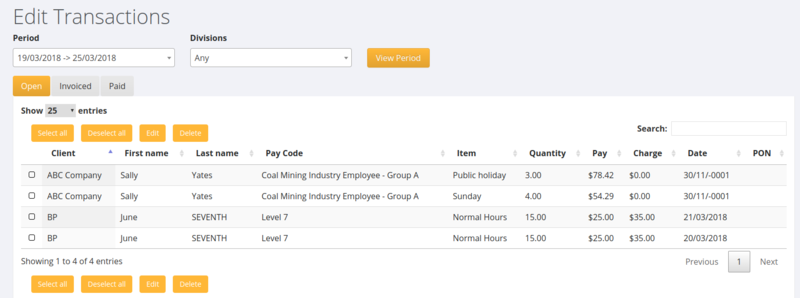

To use the edit pay rows click on the Payroll and then the Edit Pay Rows links from the main menu. From here you are shown all of the invoice rows grouped by billing location.

To filter you can enter the Period and/or the Division and then click the View Period button.

From here you are shown Transactions that are either;

- Open = Added but not processed the payroll batch nor created the invoice - here you can edit everything

- Invoiced = Have been Invoiced but not yet processed the pay - here you can't edit charge rate nor the quantity

- Paid = Have been Paid (ie processed the pay) but invoice not yet created - here you can't edit the pay rate nor the quantity

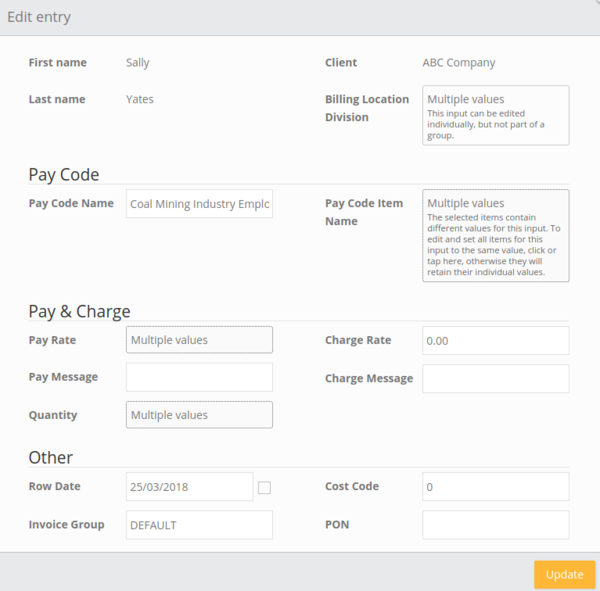

Update Rows In Bulk

To update transaction rows in bulk, simply select the rows you wish to update and click the Edit button. This will then trigger an edit form that allows for each of the rows selected to be edited with the values entered in the form - enter the required values and click the Update button.

Delete Rows

To delete transaction rows, simply select the rows you wish to delete and click the Delete button.

Making adjustments after batches have been written to the General Ledger

Example - Changed the Bank File when uploading pays

There may be times when you go to upload a bank file and the upload process triggers an error - eg the bank details for someone are incorrect. Also you may find out after processing the pays (before uploading the bank file) that you do not need to pay a person on that file.

In both of these theoretical examples you decide to delete a record from the bank file and so not pay a person who has been 'paid' in PinvoiceR. In some instances you will go back and manually pay the person (eg they provide you with their correct bank details) and in other instances you will not be paying that person at all.

In the instance that you are not paying the person at all it is imperative that you create a journal to correct the data in PinvoiceR.

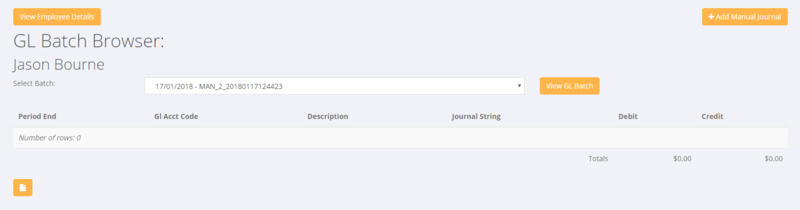

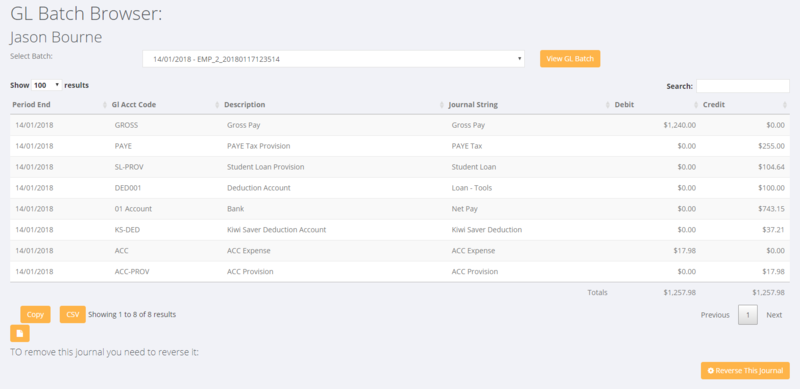

The easiest way to do that is to find the employee then click on the GL Batches button.

From here, select the relevant pay batch (period ending) and click the View Batch button.

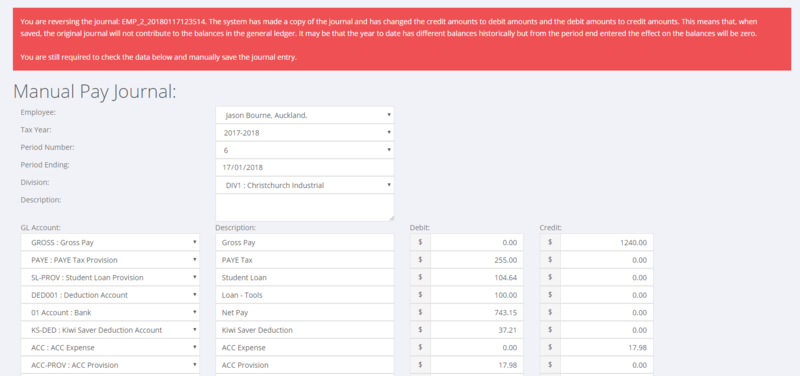

Next you click on the Reverse This Journal button. This will bring up the original full journal for that batch and confirm that you wish to reverse it - click the Save Journal button to create the reversal jorunal.

Example - Need to Adjust an employee's Pay after processing pays - AU

In this scenario you may have a situation where you have paid someone (eg last week) and you want to adjust their pay (and issue the relevant invoice/credit note) for that adjustment. Eg you paid someone 38 hours of normal and 2 of time & half last week and it turns out that they should have only been paid 36 hours of normal and 2 of time & half.

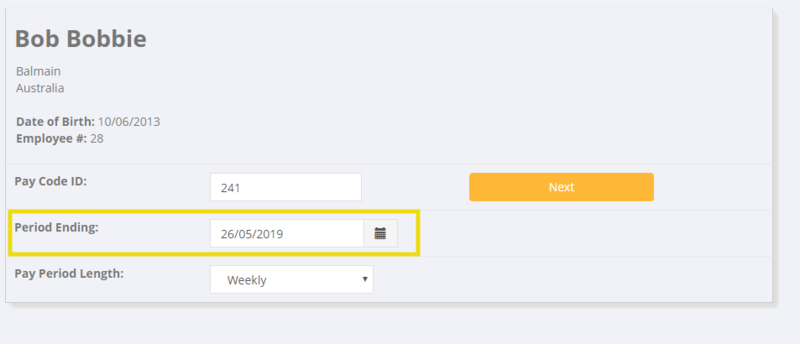

The starting point is to get to the hours entry screen - if the order is still current then you could do this from the Orders screen - else you would use the Pay Employee process to manually find the employee, select the pay code and the client billing location.

From here change the date to the relevant period ending - ie the period ending that you want to adjust (this is important as by choosing the same period ending then the system can calculate what was paid against what should have been and then adjust all of the relevant items such as tax, leave, on costs etc accordingly).

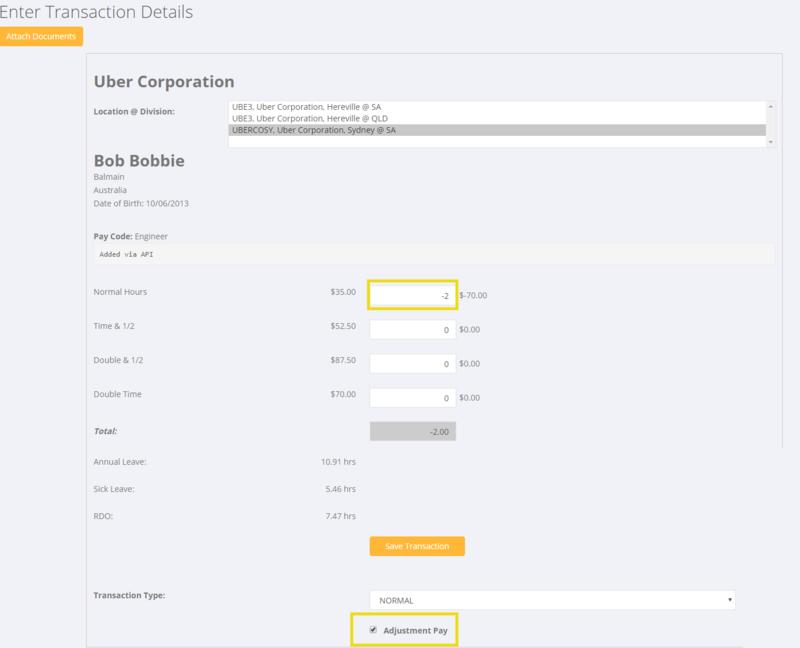

From there enter the amounts you want to adjust(eg -2 hours of Normal Time) and make sure that the Adjustment Pay option is selected. Note - if you want to create an invoice/credit note at the same time (per the usual process) then leave the transaction type to Normal - else select Do Not Charge Client to just pay/adjust the employee or Do Not Pay Employee to only create the invoice/credit note.

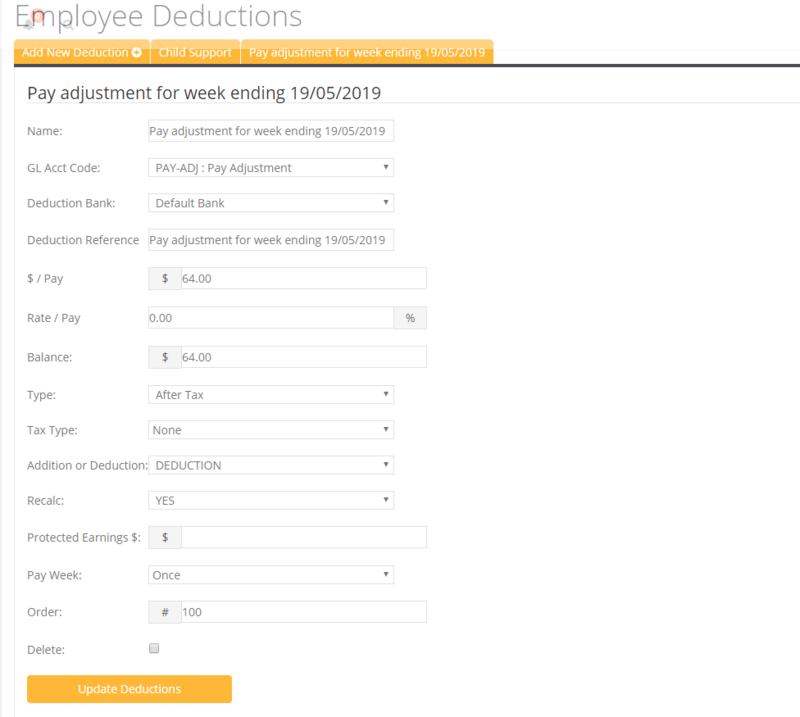

When Save Transaction this will add the adjustment pay into the open batches and you would process the batch as normal. When the batch is processed it will add the adjustment as a deduction (or addition - if the adjustment results in additional pay to the employee) and be set to process in the next pay. In the scenario that you have a large amount that you wish to deduct from the employee's next pay - if you have agreed to do this over a series of payments you can set these as required using the recalc process - see Employee Deductions for more info.

Example - Need to Adjust an employee's Tax after processing pays NZ

At this stage, manual adjustments are only available in NZ - we are soon adding a similar adjustment batch process to AU.

In this example you are advised, after processing and paying an employee that their tax code was incorrect and they we over taxed so you need to be able to refund the over tax amount.

To do this, go to the employee record and click on on the GL Batches button.

From here, select the relevant pay batch (period ending) and click the View Batch button.

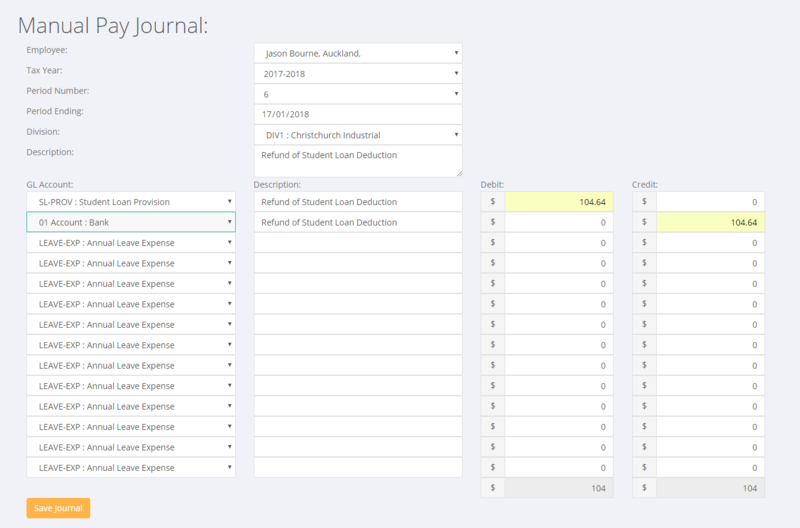

Next you right click (to open in a new window) on the + Add Manual Journal button. This will bring up a new window with a blank manual journal for the employee. By clicking between the two screens (ie the journal detail and the manual journal screen) you can complete the journal adjustments needed - eg to Reverse an over tax amount for Student Loan you would need to enter the following;

- Check Employee Name (comes from the employee you originally clicked on)

- Check Tax Year (will default to the current year)

- Check Period Number (will default to current period)

- Check Period Ending (defaults to today's date)

- Check Division (defaults to the Division set against the employee)

- Enter in the relevant journal lines (journal will not post unless it balances)

When complete click the Save Journal button.

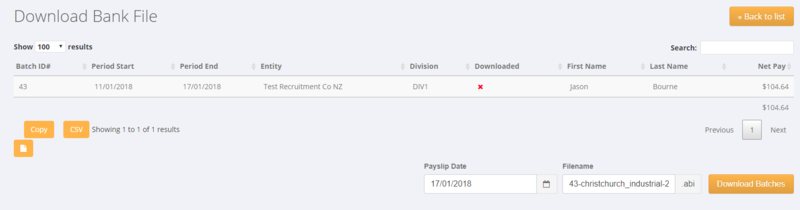

The example above will create a manual pay and because it is for an amount to be refunded the next step would be to proceed to Download Bank File and pay the employee through your bank system. A payslip is generated for the manual pay.