Difference between revisions of "Employee Deductions"

| (2 intermediate revisions by the same user not shown) | |||

| Line 7: | Line 7: | ||

* Court Fines | * Court Fines | ||

* Kiwisaver Employee Contributions (NZ) | * Kiwisaver Employee Contributions (NZ) | ||

| + | * Additional Tax payments | ||

=Use= | =Use= | ||

| Line 35: | Line 36: | ||

====Salary Sacrifice - AU==== | ====Salary Sacrifice - AU==== | ||

| − | For Australian PinvoiceR users, if your employee wishes to have a Salary Sacrifice for Superannuation, use the specific <kbd>Salary Sacrifice</kbd> tab on their employee record. | + | For Australian PinvoiceR users, if your employee wishes to have a Salary Sacrifice for Superannuation, use the specific <kbd>Salary Sacrifice</kbd> tab on their employee record. NOTE: this specific type of Deduction can not be restricted to "once per pay pay", i.e. if the employee is paid twice in a period then this deduction will come off their pay twice. The ability to limit this will be added in a future release of PinvoiceR. |

[[File:PinvoiceR_Salary_Sacrifice.png|800px]] | [[File:PinvoiceR_Salary_Sacrifice.png|800px]] | ||

| + | |||

| + | |||

| + | ====Additional Tax Payments==== | ||

| + | |||

| + | Some employees may request an additional tax deduction is made from each pay. The current method to manage this is to edit the Chart of Accounts (System -> Set Up -> Chart of Accounts Editor) and make the PAYG/PAYE GL Code a deduction account (so that it is available in the dropdown of GL Account Codes when adding a deduction). Then it is just a matter of adding a deduction (using the PAYG GL) for the extra tax - i.e the same process as any other deduction. | ||

| + | |||

| + | NB. This is a temporary method and there are some implications. Please contact PinvoiceR Support if you intend to use this for any employee. | ||

| + | |||

=Related Pages= | =Related Pages= | ||

Latest revision as of 03:18, 10 September 2020

Contents

About

Employee Deductions are used to manage a range of payroll deductions & additions and examples include;

- Super Salary Sacrifice

- Child Support Deductions

- Repayment of Loans (eg repayment for equipment provided to employee)

- Court Fines

- Kiwisaver Employee Contributions (NZ)

- Additional Tax payments

Use

It is easy to set up and manage employee pay deductions in PinvoiceR and this is done from an employee's record in the system.

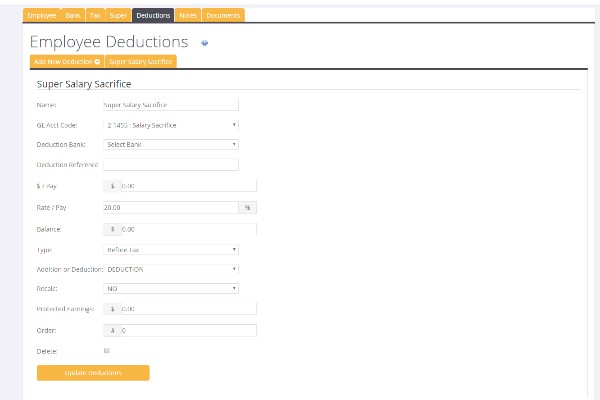

Firstly find the relevant employee's record and then from the main screen click the Deductions tab and then click the Add New Deduction button.

Enter the required information for the deduction;

After Tax Addition - New Zealand

For PinvoiceR New Zealand customers you are able to create an Addition instead of a Deduction.

To do this - select the Addition option in the drop down Addition or Deduction field.

This will add an After Tax addition - eg you want to add in a weekly after tax allowance.

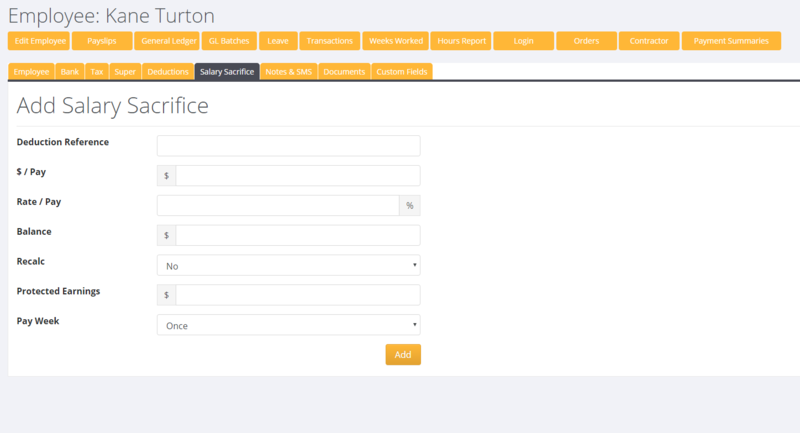

Salary Sacrifice - AU

For Australian PinvoiceR users, if your employee wishes to have a Salary Sacrifice for Superannuation, use the specific Salary Sacrifice tab on their employee record. NOTE: this specific type of Deduction can not be restricted to "once per pay pay", i.e. if the employee is paid twice in a period then this deduction will come off their pay twice. The ability to limit this will be added in a future release of PinvoiceR.

Additional Tax Payments

Some employees may request an additional tax deduction is made from each pay. The current method to manage this is to edit the Chart of Accounts (System -> Set Up -> Chart of Accounts Editor) and make the PAYG/PAYE GL Code a deduction account (so that it is available in the dropdown of GL Account Codes when adding a deduction). Then it is just a matter of adding a deduction (using the PAYG GL) for the extra tax - i.e the same process as any other deduction.

NB. This is a temporary method and there are some implications. Please contact PinvoiceR Support if you intend to use this for any employee.