Difference between revisions of "Holiday Pay - NZ"

| (3 intermediate revisions by the same user not shown) | |||

| Line 2: | Line 2: | ||

Holiday Pay in New Zealand is covered by the [https://www.employment.govt.nz/assets/Uploads/tools-and-resources/publications/leave-and-holidays.pdf Holidays Act 2003] | Holiday Pay in New Zealand is covered by the [https://www.employment.govt.nz/assets/Uploads/tools-and-resources/publications/leave-and-holidays.pdf Holidays Act 2003] | ||

| + | |||

| + | A summary of employees’ rights under the Act; | ||

| + | |||

| + | * All employees are entitled to 4 weeks’ paid annual holidays (or ‘annual leave’) each year. | ||

| + | * All employees should be entitled to take public holidays as leave, where possible for the observance of days of national, religious, or cultural significance. Where an employee does work on a public holiday that work should be specially rewarded. | ||

| + | * After 6 months employment, it is reasonable to expect employers to support their employees with sick leave and bereavement leave when required. | ||

| + | |||

=Definitions= | =Definitions= | ||

| Line 17: | Line 24: | ||

An Employment Agreement may state a special rate of relevant daily pay for the purpose of calculating payment for a public holiday, an alternative holiday, sick leave, or bereavement leave, as long as the rate is equal to, or greater than, the rate that would otherwise be calculated using the method above. | An Employment Agreement may state a special rate of relevant daily pay for the purpose of calculating payment for a public holiday, an alternative holiday, sick leave, or bereavement leave, as long as the rate is equal to, or greater than, the rate that would otherwise be calculated using the method above. | ||

| + | |||

| + | [[File:What_is_in_relevant_daily_pay.PNG |800px]] | ||

Latest revision as of 05:45, 14 February 2018

About

Holiday Pay in New Zealand is covered by the Holidays Act 2003

A summary of employees’ rights under the Act;

- All employees are entitled to 4 weeks’ paid annual holidays (or ‘annual leave’) each year.

- All employees should be entitled to take public holidays as leave, where possible for the observance of days of national, religious, or cultural significance. Where an employee does work on a public holiday that work should be specially rewarded.

- After 6 months employment, it is reasonable to expect employers to support their employees with sick leave and bereavement leave when required.

Definitions

Relevant daily pay

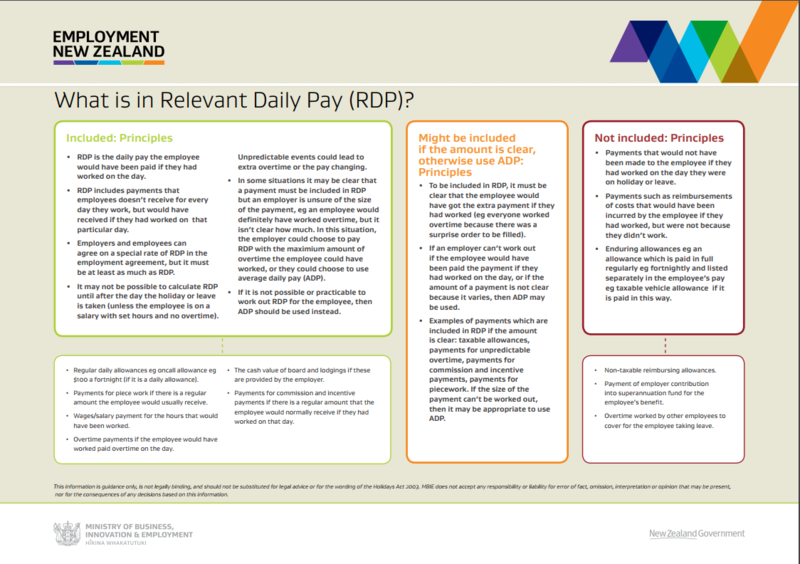

Relevant daily pay is used to calculate payment for public holidays, alternative holidays, sick leave and bereavement leave.

Relevant daily pay is the amount the employee would otherwise have earned on the day if they had worked, and includes:

- productivity or incentive payments, including commission or piece rates, if those payments would have been received had the employee worked

- overtime payments

- the cash value of board and lodgings provided.

It doesn’t include payment of any employer contribution to a superannuation scheme for the benefit of the employee.

An Employment Agreement may state a special rate of relevant daily pay for the purpose of calculating payment for a public holiday, an alternative holiday, sick leave, or bereavement leave, as long as the rate is equal to, or greater than, the rate that would otherwise be calculated using the method above.

Average daily pay

Average daily pay may be used if it isn’t possible or practicable to determine relevant daily pay, or if the employee’s daily pay varies within the pay period when the holiday or leave falls.

Average daily pay is a daily average of the employee’s gross earnings over the past 52 weeks. That is, the employee’s gross earnings divided by the number of whole or part days the employee either worked or was on paid leave or holiday during that period.

Average weekly earnings

Are determined by calculating gross earnings over the 12 months prior to the end of the last payroll period before the annual holiday is taken, and dividing that figure by 52.

The following payments make up gross earnings and should be included in the calculation:

- Salary and wages

- Allowances (but not reimbursing allowances)

- All overtime

- Piece work

- At-risk, productivity or performance payments

- Commission

- Payment for annual holidays and public holidays

- Payment for sick and bereavement leave

- The cash value of board and lodgings supplied

- Amounts compulsorily paid by the employer under ACC (i.e. the first week of compensation)

- Any other payments that are required to be made under the terms of the employment agreement. Unless the employment agreement says otherwise, reimbursement payments and discretionary or ex gratia payments ( e.g. discretionary bonuses) are not included in these calculations; nor are payments made by ACC, or when an employee is on voluntary military service, or payments for cashed-up holidays.

Ordinary Weekly Pay

Is everything an employee is normally paid weekly under the employment agreement, including:

- regular allowances, such as a shift allowance

- regular productivity or incentive-based payments (including commission or piece rates)

- the cash value of board or lodgings

- regular overtime.

Ordinary weekly pay doesn’t include irregular, one-off payments or discretionary payments.

For many people, ordinary weekly pay is quite clear because they are paid the same amount each week.

Where ordinary weekly pay is unclear for any reason, there is a formula for working it out. Ordinary weekly pay is calculated by:

- going to the end of the last pay period

- from that date, going back;

– 4 calendar weeks, or; – if the pay period is longer than 4 weeks, the length of the pay period

- taking the gross earnings for that period

- deducting from the gross earnings any payments that are irregular or the employer doesn’t have to pay, and

- dividing the answer by 4.

If an employment agreement includes an amount for ordinary weekly pay, the figure in the employment agreement must be compared with the actual ordinary weekly pay (as calculated above), and the greater of the two amounts must be used as ordinary weekly pay.

What Discretionary Payments' means

If an employer is bound under the employment agreement to make a payment, then it is not a discretionary payment. Discretionary payments are ex-gratia payments that an employer doesn’t have to pay the employee under the employment agreement.

- ‘Employment agreement’ should be considered widely ie to include variations of employment agreements, letters of offer, rules of commission schemes, bonus scheme rules, policies etc especially if the employment agreement can be said to incorporate the entitlement to participate.

- If the terms of a payment scheme are intended to be binding on the employer and employees, it is unlikely to be a discretionary payment.

- If an employment agreement states that a payment is a discretionary payment for the purposes of the Holidays Act 2003, this in itself doesn’t make it a discretionary payment. Whether the employer is bound under the employment agreement to make the payment is what determines whether or not it is discretionary.

- If an employer is bound by the employment agreement to make a payment to the employee even if the amount is discretionary (and could be zero), it is not a discretionary payment.

- If the payment is dependent on the employee and/or the organisation meeting eg any type of targets, quotas, performance criteria or indicators this does not make it a discretionary payment.

- If payments are made on a regular and consistent basis eg annually if criteria are met, it is unlikely to be a discretionary payment.

- If employees have a reasonable expectation of payment based on past practice, to the extent that the payment forms part of the employment agreement, it is unlikely to be a discretionary payment.

As it is rare for payments to be excluded it is recommended that employers seek advice before determining that a payment is discretionary, or else err on the side of caution and include the payment.

Examples of payments which are unlikely to be discretionary payments for the purposes of the Holidays Act 2003.

- An employee’s remuneration statement includes a bonus amount at 100%. The bonus is covered by bonus rules that state that payment of and amount of the bonus is dependent on company and employee performance.

- An employee’s employment agreement has an amount for on target earnings (OTE) for commission. The actual amount of commission earned by the employee will depend on how many sales they make.

- Each year the company decides who will be participating in the bonus scheme. Letters are sent out to employees who will be participating telling them that they are eligible to participate this year. The letters state that the amount they receive depends on their performance and could be zero.

- A company gives all employees a Christmas bonus each year. This helps them recruit and keep good staff and employees are told about it by their employer when they start work with the company.

Examples of payments which are likely to be discretionary payments for the purposes of the Holidays Act 2003

- A business has had a really good year and the owner decides to give everyone a one-off bonus to reward their hard work. They do not do this regularly.

- A company gives all employees a Christmas bonus from time to time.

- A company decides that one employee has had an outstanding year and will be given an ex-gratia lump sum payment of 10% of their wages for the last 12 months.

Paying Holiday Pay In Advance

Where Employees Request Holiday Leave In Advance

Employees can ask their employer to take paid annual holidays in advance of becoming entitled to them and the employer can choose whether or not to approve annual holidays in advance, unless the employee has a right to take annual holidays in advance in their employment agreement.

The payment for holidays taken in advance is still based on the greater of the employee’s ordinary weekly pay or average weekly earnings.

If an employer approves annual holidays in advance, they should make sure that the employee has agreed in writing that the employer can deduct any advance payment of holiday pay from their final pay.

Holiday Pay in Regular Annual Closedown period

An employer can choose to have an Annual Closedown once a year and require employees to take annual holidays during the period of the closedown, even where this requires employees to take time off for which they are not fully reimbursed. The employer is required to provide employees with at least 14 days’ advance notice of the closedown.

Calculating an employee’s annual holiday entitlement is different if the employer chooses

to have a regular or customary annual closedown. The closedown can occur either:

- across the entire workplace (for example, where a company closes over the Christmas/New Year period), or

- for part of an enterprise (for example, where the factory closes for maintenance while the office, dispatch and sales departments remain open).

To determine whether a day that falls during a closedown period would be an ‘otherwise working day’ in regard to entitlements to public holidays, alternative holidays, sick leave and bereavement leave, see the section below on ‘Public holidays during a closedown period’.

Employees who have been employed for less than 12 months at the date of closedown will not have worked long enough to be entitled to annual holidays. In this situation the employer must pay;

- 8% of gross earnings since their start of employment less any payment for annual holidays taken in advance.

- In addition to the payment of the 8%, the employer and employee may agree to the employee taking paid annual holidays in advance of their entitlement (these holidays will be deducted from the next year’s entitlement).

- The employee’s anniversary date for annual holidays entitlement must move to the date of the start of the closedown (or another date close to the start of the closedown) and they will not be entitled to any annual holidays for another 12 months.

For all employees whose work is subject to a regular annual closedown, the employer can nominate a date that will be treated as the date that the closedown begins, and on which the employees become entitled to annual holidays. This date must be reasonably connected to the timing of the regular annual closedown. For example, where there is a Christmas closedown, the date could be set at 15 December to ensure that it always comes before the annual closedown commences.

Other than in this situation, an employer cannot nominate a particular date for annual holiday entitlement calculations.

An employer who wants to implement more than one closedown in any year can if their employees agree, but can’t make them take annual holidays using the above provisions. The date of entitlement to annual holiday is not adjusted by a second closedown.