Difference between revisions of "ACC First Week - NZ"

(Created page with "=About= This article concerns how to make ACC payments for the first week that an employee is entitled to ACC in New Zealand. =How to use= ====Set up a Global Pay Code for...") |

(No difference)

|

Revision as of 05:05, 28 March 2018

Contents

About

This article concerns how to make ACC payments for the first week that an employee is entitled to ACC in New Zealand.

How to use

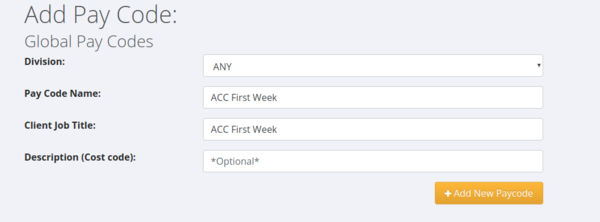

Set up a Global Pay Code for ACC First Week

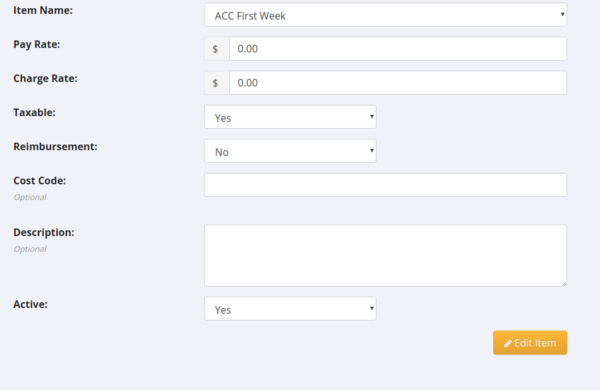

The simplest method is to add a Pay Code Item and call it ACC First Week. Then add a Global Pay Code and call it ACC First Week.

From here edit the Global Pay Code and add the Pay Code Item - ACC first week to it - setting the pay and charge rates to $0.00

Calculating the ACC Pay Amount

In New Zealand the first week's ACC compensation is paid directly by the Employer and it is calculated at 80% of what the employee earned during the 7 days immediately before the day on which the incapacity commenced (note that this is not necessarily be the day of the accident).

Earnings include:

- Ordinary time;

- Overtime;

- Taxable allowances;

- Taxable bonuses; and

- Income from other employment.

The employer must then pay the employee 80% of the earnings they lost during the 7 days immediately before the incapacity commenced.

Note that 80% of the lost earnings will not necessarily be the same as 80% of the total earnings in the 7 days before incapacity. For example, if the injury only caused the employee to be unable to work for 2 or 3 days, and they were able to work for the rest of the week, they would have earned at least a portion of their income from the previous week.