Show Base Rate & Casual Loading on Payslips

About

In Australia, Work advises to show "any loadings (including casual loading), allowances, bonuses, incentive-based payments, penalty rates or other paid entitlements that can be separated out from an employee’s ordinary hourly rate.

"For example, a note could be included on a pay slip that the hourly rate incorporates the relevant casual loading."

How to Use

In PinvoiceR you can choose to set information about casual loading at either the Pay Code level or at the Pay Code Item Level.

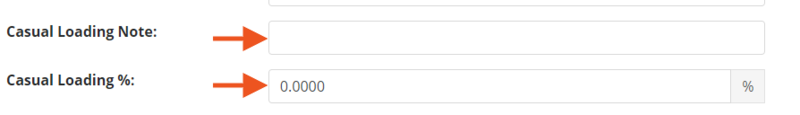

If you set it at the Pay Code Level - it is a matter of entering the casual loading percentage and/or the casual loading note (ie text) when you are editing a pay code. The information entered here is then added to the employee's payslip when they are paid with that pay code.

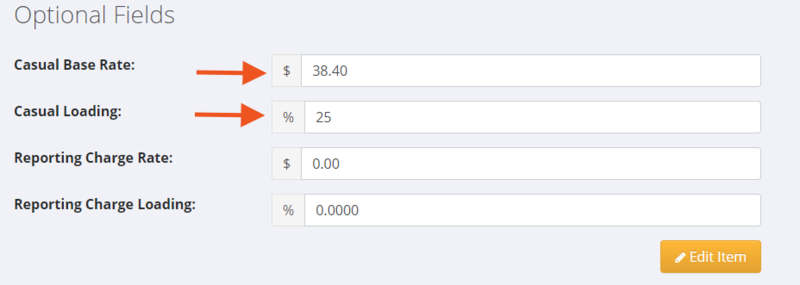

If you set it at the Pay Code Item Level you are then able to show more detail for the casual loading for that specific pay code item. Here you are able to set the base rate and the casual loading and from there, when the pay slip is created the casual loading amount is calculated. This can be useful when you clearly want to indicate what the loading amount is that is included in a person's pay rate.

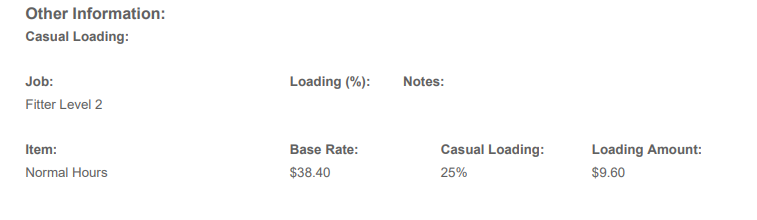

For example you may have a scenario where the pay rate is $48.00 per hour and this includes a casual loading of 25%. To show the casual loading amount you would set the base rate to $38.40 and enter 25% casual loading. This would then show the casual loading amount of $9.60 on the employee's payslip.

Example of information on payslip: