Difference between revisions of "Annual Leave - AU"

| Line 64: | Line 64: | ||

| − | + | ==Related Pages== | |

* [[RDO - AU]] | * [[RDO - AU]] | ||

* [[Pay Codes]] | * [[Pay Codes]] | ||

* [[Pay Code Item Editor]] | * [[Pay Code Item Editor]] | ||

Revision as of 01:22, 3 March 2020

Contents

About

All employees except casuals qualify for Annual and Sick Leave. The requirements for this are explained on the FairWork website (https://www.fairwork.gov.au/leave/annual-leave and https://www.fairwork.gov.au/leave/sick-and-carers-leave/paid-sick-and-carers-leave).

For those employees who are entitled to Leave, an amount is added to their leave balance for each hour they work. This is enabled by setting the rate at which they accrue Annual and Sick leave on qualifying* Pay Code Items. When an employee comes to take leave then they are paid with special Pay Code Items that will reduce their leave balance.

Accrual rate

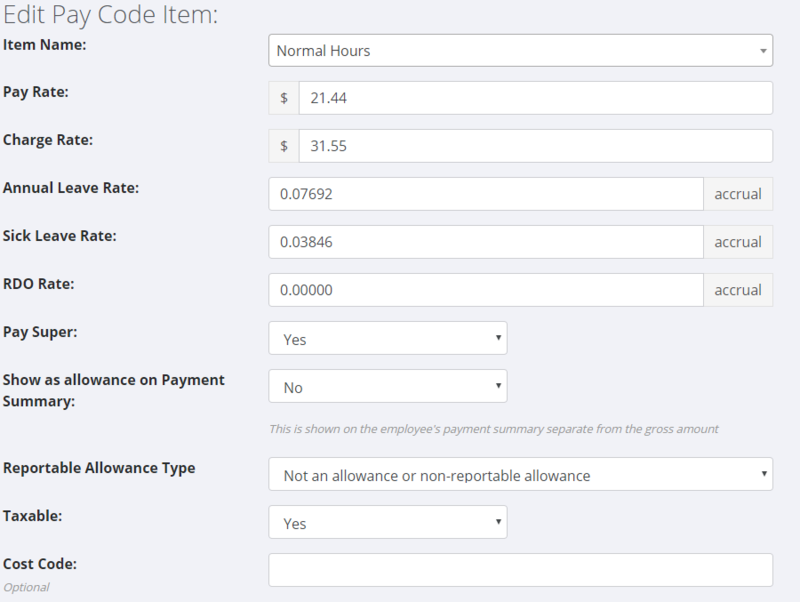

If an employee is entitled to 4 weeks of Annual Leave a year and works 52 weeks in that year, then their rate is 4/52 = 0.07692. Likewise, if they receive 2 weeks of Sick Leave per annum their rate is 2/52 = 0.03846.

What type of work qualifies for leave?

Normal work hours (typically paid as "Normal Hours") and Annual Leave and Sick Leave all qualify. NB. while on leave an employee accumulates further leave. Accruing leave is based on 2 weeks or 4 weeks of normal work hours per annum, hence there is no accrual for Time and 1/2, Double Time, etc.

Financial implications

As hours as added to an employee's leave balance a financial provision must be made against the future cost that will be incurred when the employee takes the leave. This occurs by linking the accrual of hours against a specific "provision" GL code and the taking of those hours against an "expense" GL code.

How to use

Set the Leave Factors first

Settings used to pay leave

When the below Pay Code Items are used to pay an employee Annual, Sick or RDO Leave hours the system will know to deduct those hours from their relevant leave balance.

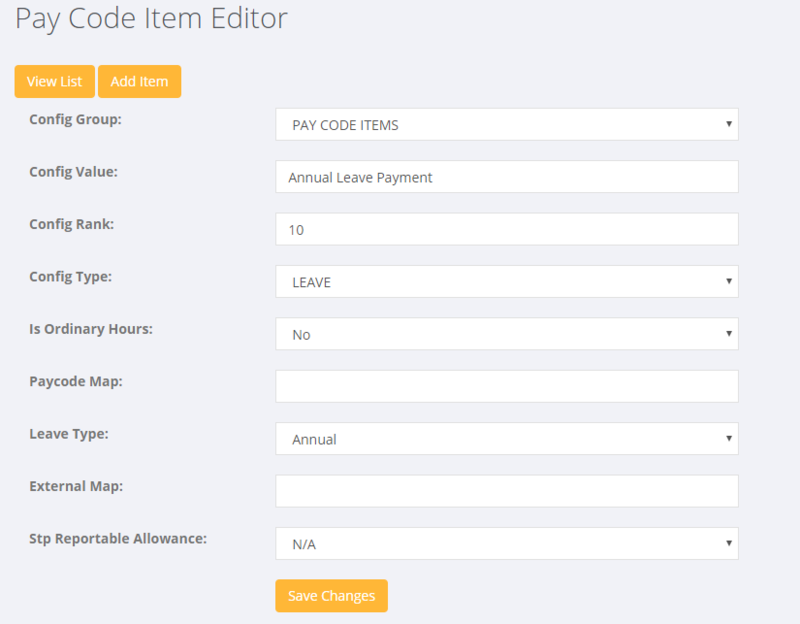

- Navigate to System > Set Up > Pay Code Item Editor and Add Item. Create an Item called "Annual Leave Payment" (or similar), setting the Config Type to "Leave" and the Leave type to "Annual".

- Add a second Item called "Sick Leave" (or similar), setting the Config Type to "Leave" and the Leave type to "Sick".

Settings used to accumulate leave

Every employee entitled to leave must use a Pay Code that is set to accumulate leave at the correct rate.

- Create or edit a Pay Code, either by System > Global Pay Codes or by selecting the Pay Codes tab on a client record.

- Select the Pay Code Item "Normal Hours", or add it if it doesn't already exist.

- Scroll down and set the accrual rates for Annual Leave Rate and Sick Leave Rate.

Financial settings

- In System > Set Up > Chart of Accounts Editor set up specific GL Codes for Annual Leave Expense, Annual Leave Provision, Sick Leave Expense and Sick Leave Provision.

- In System > Set Up > Division Editor, edit each Division and select the Chart of Accounts tab. Set the Annual Leave Expense, Annual Leave Provision, Sick Leave Expense and Sick Leave Provision fields to their appropriate GL Codes.

Paying Annual or Sick Leave

Once the above Leave Factors have been set up this is the same as a normal pay employee procedure - i.e. enter the hours you wish to pay against the pay code item for the Annual or Sick pay.

Adjusting Leave

Once the Pay Code Items are setup an employees leave balance will increase and decrease automatically. But there may be some circumstances where you need to adjust the balance, for example, where you are just setting up an employee to use these Pay code Items but they already have an agreed leave balance. On the employee record select the Leave tab. Here you can manually add additional hours or remove them by adding a negative value.