Difference between revisions of "Employee Deductions"

Jump to navigation

Jump to search

(→Use) |

|||

| Line 22: | Line 22: | ||

<table style="border-collapse:collapse;border-spacing:0"><tr><th style="font-family:Arial, sans-serif;font-size:14px;font-weight:bold;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;background-color:#ffb737;text-align:center" colspan="2">Explanation of Deduction Fields</th></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Name</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Internal Name for the deduction</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">GL Account Code</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The General Ledger account code that you want to link the deduction to</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Deduction Bank</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">[[Manage Deduction Banks]] - The banking details that you want to link the deduction to - ie when set, this field will create the payment batch in your bank pay file to directly process the payment of the deduction as you pay the person - eg pay directly to Court for Court Fine Deductions</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Deduction Reference</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is the reference text that you want on a person's payslip explaining the deduction</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">$/Pay</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The fixed dollar amount per pay to deduct (ie use this or Rate/Pay for percentage - not both)</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Rate/Pay</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The percentage per pay that you want to deduct each pay - eg if gross wages were $1,000 and you set it a rate of 5% then $50 would be deducted for that pay</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Balance</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Where there is a finite amount that is being deducted - eg in the instance that they have been loaned money for $1,000 of Tools and once they have paid it all back there are no further deductions needed - note for this to function you need to set Recalc to Yes</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Recalc</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is used to adjust the outstanding balance of an owed deduction. Set it to yes and each time that a deduction is made it will adjust the balance owing to reflect the amount paid back and automatically cease deductions when the full total has been repaid. This process will also adjust the final payment amount - eg in the instance that the $/Pay is $100 and they only owe $10 then the deduction for the pay will be $10.</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Threshold</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Use this to set a threshold for gross wages so that deductions will only occur above that threshold</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Order</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is used to order the added deduction tabs - set to 1 for first tab, 2 to second tab, etc</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Delete</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">To remove the deduction - ie select the delete option and click the <kbd>Update Deductions</kbd> button</td></tr></table> | <table style="border-collapse:collapse;border-spacing:0"><tr><th style="font-family:Arial, sans-serif;font-size:14px;font-weight:bold;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;background-color:#ffb737;text-align:center" colspan="2">Explanation of Deduction Fields</th></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Name</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Internal Name for the deduction</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">GL Account Code</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The General Ledger account code that you want to link the deduction to</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Deduction Bank</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">[[Manage Deduction Banks]] - The banking details that you want to link the deduction to - ie when set, this field will create the payment batch in your bank pay file to directly process the payment of the deduction as you pay the person - eg pay directly to Court for Court Fine Deductions</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Deduction Reference</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is the reference text that you want on a person's payslip explaining the deduction</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">$/Pay</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The fixed dollar amount per pay to deduct (ie use this or Rate/Pay for percentage - not both)</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Rate/Pay</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">The percentage per pay that you want to deduct each pay - eg if gross wages were $1,000 and you set it a rate of 5% then $50 would be deducted for that pay</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Balance</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Where there is a finite amount that is being deducted - eg in the instance that they have been loaned money for $1,000 of Tools and once they have paid it all back there are no further deductions needed - note for this to function you need to set Recalc to Yes</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Recalc</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is used to adjust the outstanding balance of an owed deduction. Set it to yes and each time that a deduction is made it will adjust the balance owing to reflect the amount paid back and automatically cease deductions when the full total has been repaid. This process will also adjust the final payment amount - eg in the instance that the $/Pay is $100 and they only owe $10 then the deduction for the pay will be $10.</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Threshold</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">Use this to set a threshold for gross wages so that deductions will only occur above that threshold</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Order</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">This is used to order the added deduction tabs - set to 1 for first tab, 2 to second tab, etc</td></tr><tr><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;font-weight:bold;vertical-align:top">Delete</td><td style="font-family:Arial, sans-serif;font-size:14px;padding:10px 5px;border-style:solid;border-width:1px;overflow:hidden;word-break:normal;vertical-align:top">To remove the deduction - ie select the delete option and click the <kbd>Update Deductions</kbd> button</td></tr></table> | ||

| + | |||

| + | |||

| + | ===After Tax Addition - New Zealand=== | ||

| + | |||

| + | For PinvoiceR New Zealand customers you are able to create an Addition instead of a Deduction. | ||

| + | |||

| + | To do this - select the Addition option in the drop down Addition or Deduction field. | ||

| + | |||

| + | This will add an After Tax addition - eg you want to add in a weekly after tax allowance. | ||

=Related Pages= | =Related Pages= | ||

*[[Employee Deduction Report]] | *[[Employee Deduction Report]] | ||

*[[Manage Deduction Banks]] | *[[Manage Deduction Banks]] | ||

Revision as of 23:24, 23 April 2018

About

Employee Deductions are used to manage a range of payroll deductions & additions and examples include;

- Super Salary Sacrifice

- Child Support Deductions

- Repayment of Loans (eg repayment for equipment provided to employee)

- Court Fines

- Kiwisaver Employee Contributions (NZ)

Use

It is easy to set up and manage employee pay deductions in PinvoiceR and this is done from an employee's record in the system.

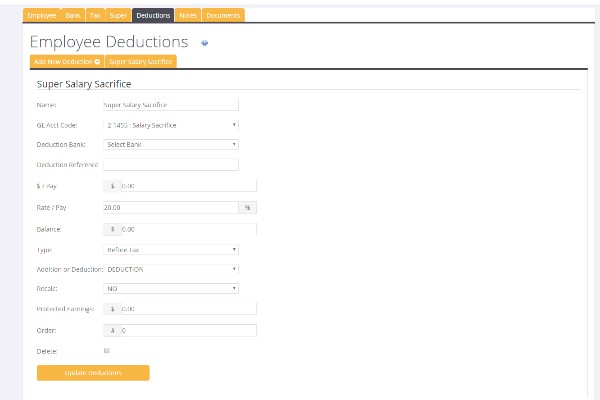

Firstly find the relevant employee's record and then from the main screen click the Deductions tab and then click the Add New Deduction button.

Enter the required information for the deduction;

After Tax Addition - New Zealand

For PinvoiceR New Zealand customers you are able to create an Addition instead of a Deduction.

To do this - select the Addition option in the drop down Addition or Deduction field.

This will add an After Tax addition - eg you want to add in a weekly after tax allowance.