Difference between revisions of "Workcover"

| Line 28: | Line 28: | ||

* Set the Payroll Tax Exempt to Yes | * Set the Payroll Tax Exempt to Yes | ||

* Add the Billing Location Divisions - pick relevant WIC but set rate to 0%. | * Add the Billing Location Divisions - pick relevant WIC but set rate to 0%. | ||

| + | |||

| + | Then set up a Workcover - Claimable & Workcover - Non Claimable pay code for that client - in doing this you can set each Pay Code to appear on Sales Reports or not. | ||

| + | |||

| + | [[File:Workcover_Pay_Code.png|600px]] | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | Set up each with the relevant pay code item (Workcover Claimable or Workcover - Non Claimable). Set the pay rate to $1 and charge rate to $0. If superannuation is not applicable (as is usually the case - but you need to determine this) - then set Superannuation to No for both pay code items. If you want to track the costs associated with each of the pay code items - add in a relevant code (eg the GL code that you use for Workcover Costs) in the cost code section | ||

| + | |||

| + | [[File:Workcover_Pay_Code_Item.png | 600px]] | ||

=Related Pages= | =Related Pages= | ||

Revision as of 22:56, 11 July 2018

About

In your payroll there may be instances where you need to manage the payment (and potentially the recovery) of workcover wages to employees. The following is an overview of a process that you could use to both correctly process and also track Claimable and Non-Claimable workcover payroll costs.

How to Use

The things to consider when paying workcover pays include;

- Superannuation (in the main workcover pays do not attract superannuation - but do in some cases where the agreement/award that the employee is paid under specifies that they are due to be paid superannuation when on Workcover)

- Payroll Tax - generally, workcover pays do not attract payroll tax

- Workcover - workcover pays do not attract workcover levies.

- Tracking the costs of Claimable vs Non-Claimable pays

- Tracking the costs of Workcover Pays for specific clients - ie being able to measure the cost of wages for employees injured at a specific client.

- Assigning some costs (eg Non-Claimable) to a Sales Report and excluding others (eg Claimable)

First Steps

Make sure that you have pay code item names created for Workcover Claimable & Workcover Non-Claimable - see Pay Code Item Editor

Then, to track the costs against a client - set up a new billing location for that client - in doing so;

- Set the Payroll Tax Exempt to Yes

- Add the Billing Location Divisions - pick relevant WIC but set rate to 0%.

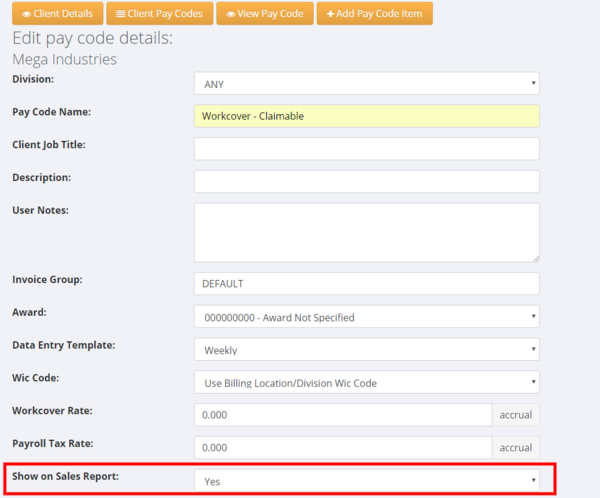

Then set up a Workcover - Claimable & Workcover - Non Claimable pay code for that client - in doing this you can set each Pay Code to appear on Sales Reports or not.

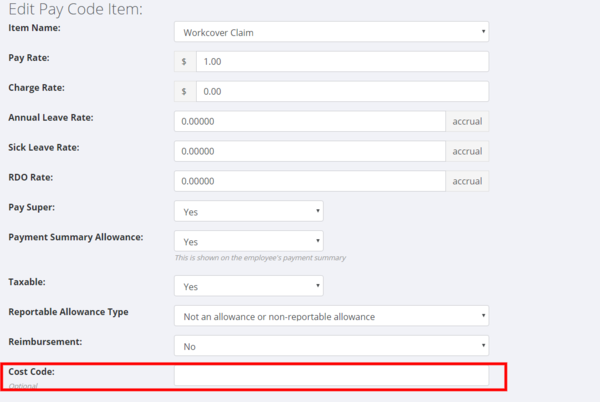

Set up each with the relevant pay code item (Workcover Claimable or Workcover - Non Claimable). Set the pay rate to $1 and charge rate to $0. If superannuation is not applicable (as is usually the case - but you need to determine this) - then set Superannuation to No for both pay code items. If you want to track the costs associated with each of the pay code items - add in a relevant code (eg the GL code that you use for Workcover Costs) in the cost code section