Add Invoice

Contents

About

The Add Invoice function is only used to add invoices (either for accounts receivable or for accounts payable) that are not related to invoices for hours paid. For hours type invoices use the Paying Employees processes.

How to Use

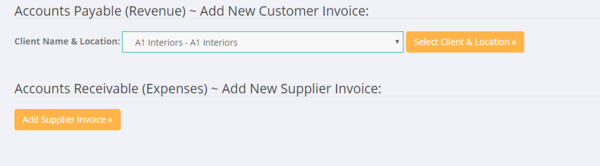

From the main menu click on the Invoices and then the Add Invoice link.

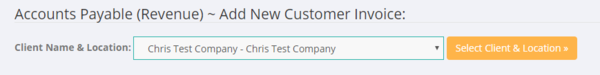

Create an Accounts Receivable Invoice/Credit Note

To add an accounts receivable invoice or credit note - select the relevant client and click the Select Client & Location button.

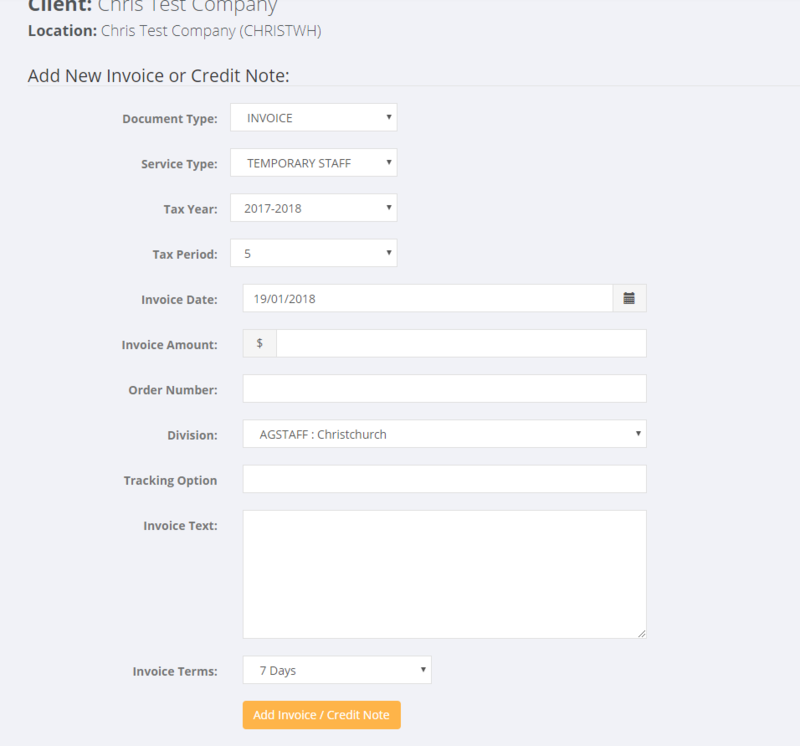

Fill in the add invoice form - noting the following;

- Document Type - Invoice or Credit Note

- Service Type - select relevant service type

- Tax Year - select Tax Year

- Tax Period - select Tax period

- Invoice Date - enter invoice date

- Invoice Amount - enter amount exclusive of GST

- Division - select division

- Tracking Option - enter if using in external program such as Xero

- Invoice text - enter the details of the invoice yo uare creating

- Invoice Terms - Select Terms

Then click the Add Invoice/Credit Note button.

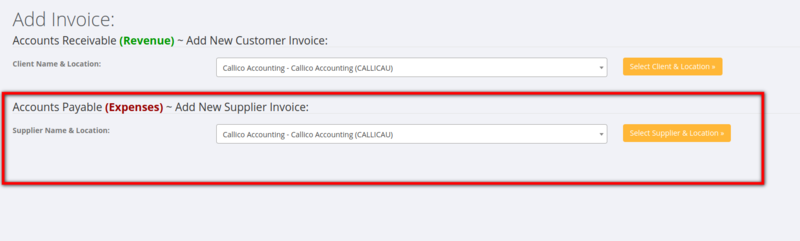

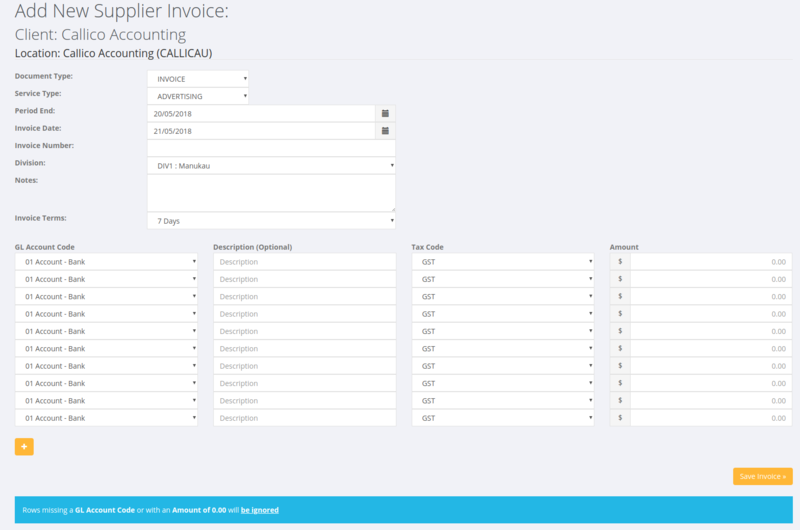

Create an Accounts Payable Invoice/Credit Note

This method is is only used to add a supplier invoice so that it can be taken up on a weekly sales report. For example, you may have a direct cost of recruitment (eg Advertising Costs, external suppliers, etc) that you wish to be reflected on the weekly sales report.

From the main menu click on the Invoices and then the Add Invoice and then choose the relevant supplier from the dropdown list (note if the supplier is not there you will need to add it first) - the click the Select Supplier & Location button.

Then select the supplier name and click on the Select Supplier button. Then enter the details for the accounts payable (supplier invoice).

From here, enter the details of the supplier invoice - note: the period end date will determine the weekly sales report that the supplier costs are allocated to.