Termination Pays NZ

Jump to navigation

Jump to search

About

This article covers the steps in PinvoiceR that are taken to terminate an employee.

How to Use

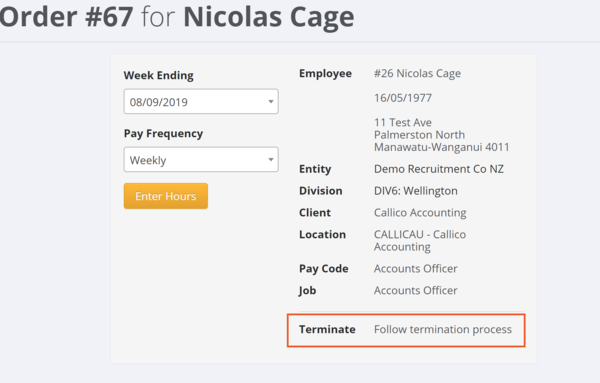

To access the termination process for an employee you can either do this from the Leave Settings section or from an hours entry screen - eg below;

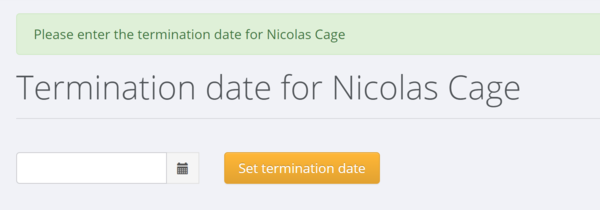

When you do this you are presented with the following termination form to set the termination date;

Once the termination date has been set then the termination calculation form is shown. The values on the right side of the form (in grey) are the values for that employee - eg;

- Notice Period - is the number of days since their last pay and the termination date you set

- Annual Leave Balance - is the number of weeks leave the employee has outstanding - ie if they have not worked for 12 months this will be zero

- Upcoming Public Holidays - in the instance that in the period of notice given there is a public holiday they will need to be paid for this as well. In this case you enter the number of public holidays that are in the notice period

- Alternative Leave Balance - if the employee had worked (prior to termination) on a public holiday then they are due an Alternative Leave Day. If the employee has any of these outstanding they will show here.

- Other leave payments amount - use this to record any other leave payments not in the system

- Contractual payments amount - use this if there are any other contractual payments due on termination

- Gross from pay amounts & General ledger gross are both shown to indicate the earnings the employee has had from their last anniversary date. Both are shown as in some instances their will be differences - eg anniversary date is mid week - or the GL contains opening balances (ie transferred from another system) that are not in transactions. Choose which ever amount is the correct one for your employee.

- Pay as you go Annual Leave Payouts - Annual leave payouts are removed before getting the 8% subtotal. If the amount shown here is $0.00, then the employee has been accruing their annual leave balance rather than showing it on payslip

- Annual leave taken in advance - If you have paid an employee any annual leave in advance of them accruing their annual leave entitlements it must be removed from the total. The figure shown here is the total amount of annual leave paid out since the last anniversary date (or start date).

- Non-taxable reimbursing allowances amount - use this to enter any non taxable allowance that you are paying on termination

- Compensatory payments amount - use this to enter any compensatory payments you are paying on termination

Error creating thumbnail: File with dimensions greater than 12.5 MP