Difference between revisions of "Single Touch Payroll"

(→About) |

|||

| Line 12: | Line 12: | ||

=How to use= | =How to use= | ||

| + | |||

| + | Once you have completed a pay run and posted the batch to the general ledger, from the main menu click on <kbd>Payroll</kbd> and then the <kbd>Filing</kbd> links. | ||

| + | |||

| + | From here you are shown a summary of payroll events yet to be sent to the ATO - <kbd>To be sent</kbd> and payroll events that have previously been sent - <kbd>Sent</kbd>. | ||

| + | |||

| + | |||

| + | [[File:STP.png|600px]] | ||

=Related Pages= | =Related Pages= | ||

Revision as of 02:43, 24 June 2018

About

Single Touch Payroll is a reporting change for employers in Australia. It starts from 1 July 2018 for employers with 20 or more employees.

You will report payments such as salaries and wages, pay as you go (PAYG) withholding and superannuation information from PinvoiceR each time you pay your employees.

Single Touch Payroll will be expanded to include employers with 19 or less employees from 1 July 2019 (This is subject to legislation being passed in parliament).

From the ATO Website " During the first 12 months that you report through STP you will be exempt from an administrative penalty for failing to report on time. This is unless we have first given you written notice advising that a failure to report on time in the future may attract a penalty."

Before you start

How to use

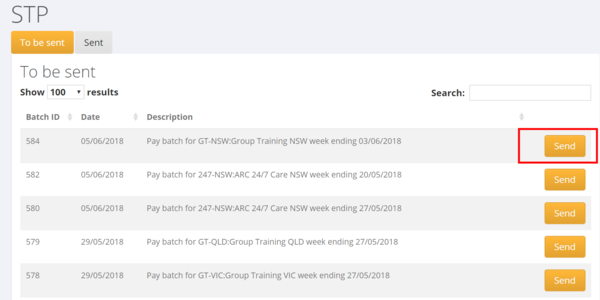

Once you have completed a pay run and posted the batch to the general ledger, from the main menu click on Payroll and then the Filing links.

From here you are shown a summary of payroll events yet to be sent to the ATO - To be sent and payroll events that have previously been sent - Sent.