Pay Codes

Contents

About

Pay Codes are used in PinvoiceR to store the pay and charge information needed to both create a pay and to raise an invoice.

Setting Up a Pay Code

In most cases the Pay Code information for a particular client will come from your front end system (eg in RecruitOnline there is a function to export a Rate Schedule - ie paycode - to PinvoiceR). In other systems the pay codes may be automatically created from new orders.

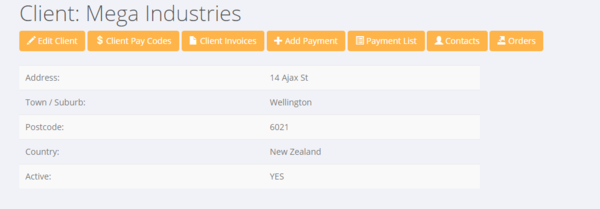

In either case there will be a need to edit a pay code to ensure that it is set up correctly and also you can add a pay code manually in PinvoiceR. To see a list of pay codes for a specific client - click on the $ Client Pay Codes button.

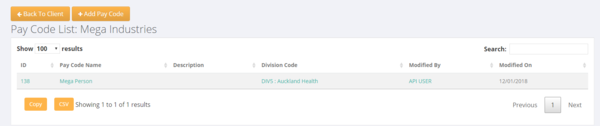

From here you are shown a list of the existing pay codes set up for that client. Click on the + Add Pay Code button to add a pay code.

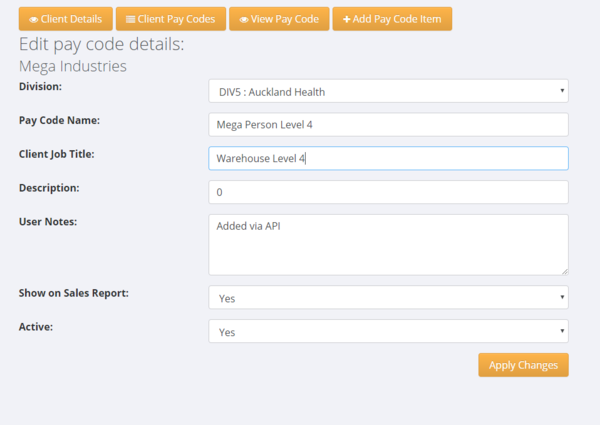

Enter the relevant details in the Add Pay Code form;

Pay Code Fields in AU are:

- Division: - The division that applies

- Pay Code Name: - Name of Pay Code - note Invoice and Paylsip will use this if Client Job Title is blank

- Client Job Title: - Name of Paycode you want for Invoice and Payslip

- Cost Code: - A code you can use to report on at the Pau Code Item level

- User Notes: - Notes on the Pay Code

- Invoice Group: - A way to automatically group pay codes on seaprate invoices - ie if two pay codes were set to same (eg Default) then each would be on the same invoice - else if they have different group names they would be on separate invoices

- Work Type: - Casual or Permanent

- Award: - Name of Award/EBA (if applicable)

- Payroll Instrument: - Name of Payroll Instrument (if applicable)

- Award Interpretation: - Pay/Award Rule assigned - ie if using online timesheets

- Data Entry Template: - Weekly or Daily

- Wic Code: - WIC Code - ie if you need to set this at the job level (such as in NSW) instead of the client billing location level

- Workcover Rate: - Workcover Rate - ie if you need to set this at the job level (such as in NSW) instead of the client billing location level

- Payroll Tax Rate: - Payroll Tax Rate - ie if you need to set this at the job level

- Show on Sales Report: - Option to include/exclue from Sales Report

- Client Group Rate: - If you wish to make the pay code available to other clients under a Client Group

- Casual Loading Note: - Text that you wish to use for Casual Loading statement on payslips

- Casual Loading %: - Casual loading percentage that you want to use for Casual Loading statement on payslips

- Active: - Set pay code to Active/Inactive

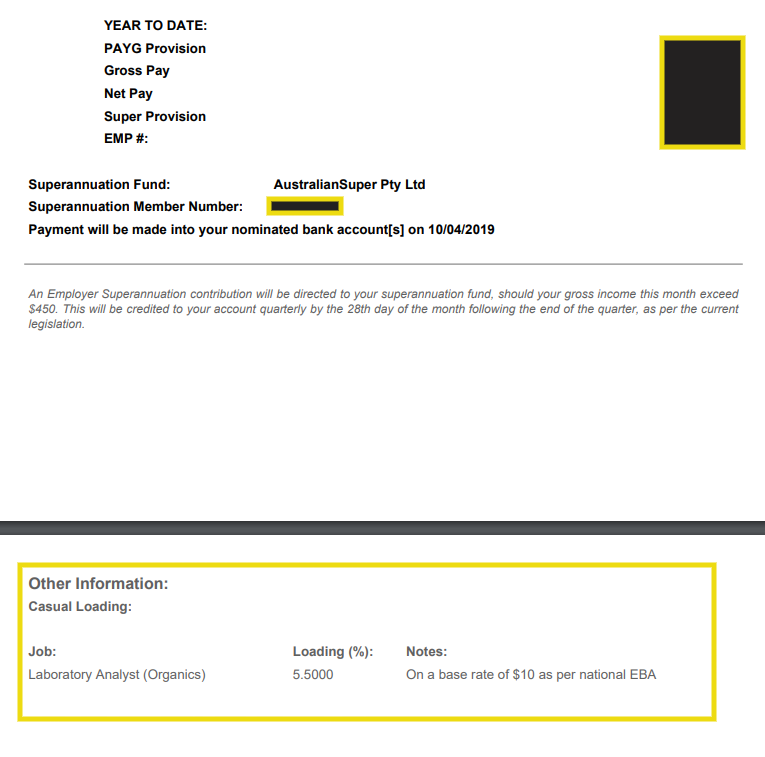

Casual Loading on Payslips

As mentioned above, the information for Casual Loadings can be shown on an employee's payslip. To do this, fill in the Casual Loading Note and/or the Casual Loading % fields on the pay codes.

Whatever you put in these fields are then used on the payslip. If no information is put in the fields then the Casual Loading comment will not appear on the employee's payslip.

Setting Up Pay Code Items

Pay code items are at the core of how some one is paid and how a client is charged. Again, these are automatically generated when a pay code is set up from an integrated system (eg RecruitOnline) but may also be added manually and need to be edited once exported into PinvoiceR.

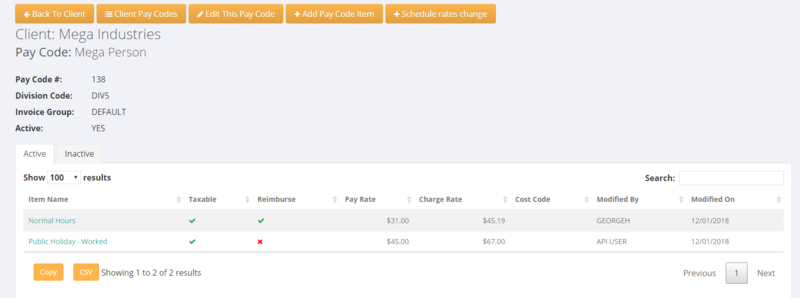

To bring up the detail of the pay code items, click on the pay code item in the list of pay codes for that client.

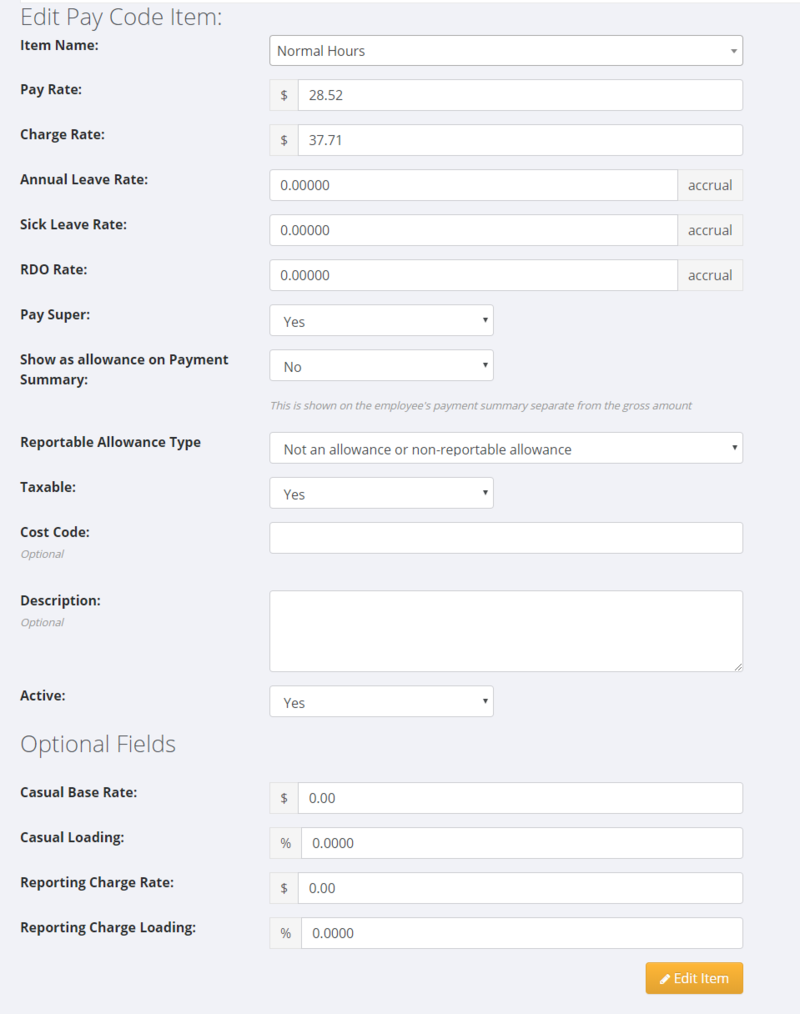

Pay Code Items - AU

The following is the form for a Pay Code Item in PinvoiceR for AU customers.

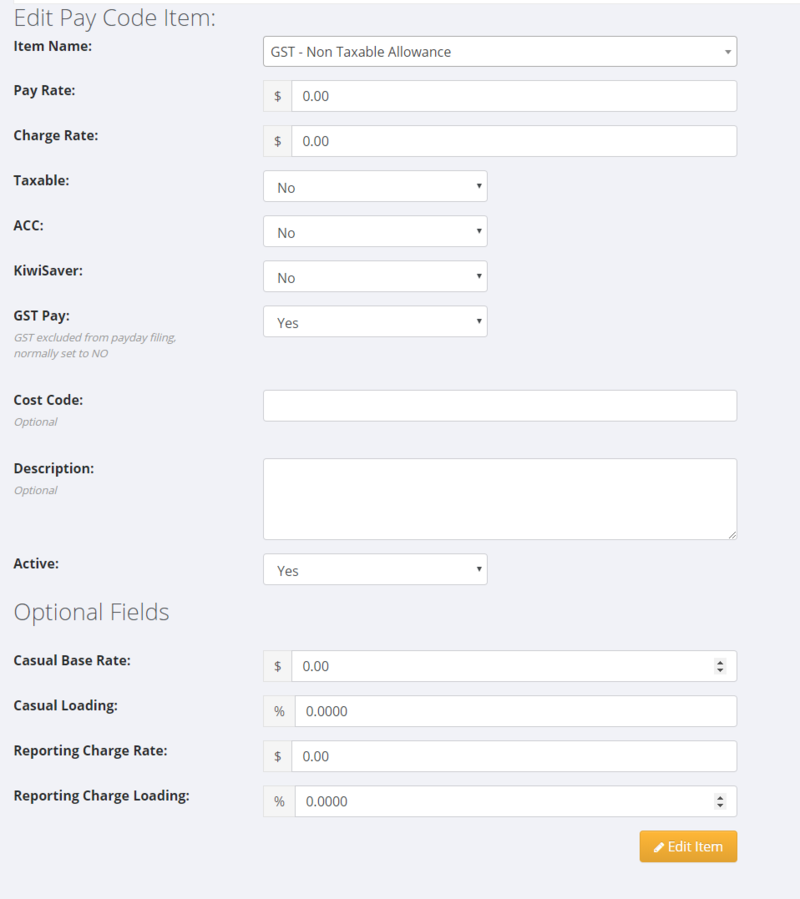

Pay Code Items - NZ

The following is the form for a Pay Code Item in PinvoiceR for NZ customers.