Difference between revisions of "Pay Day Filing"

| Line 40: | Line 40: | ||

The batches not previously submitted will show on the <kbd>Queued</kbd> tab. Ones that have been previously submitted are on the <kbd>Archived<kbd> tab. | The batches not previously submitted will show on the <kbd>Queued</kbd> tab. Ones that have been previously submitted are on the <kbd>Archived<kbd> tab. | ||

| − | Click on the <kbd>View</kbd> button to see the detail of the batch(es) and then click on the <kbd>Download<kbd> button to download the CSV. | + | Click on the <kbd>View</kbd> button to see the detail of the batch(es) and then click on the <kbd>Download</kbd> button to download the CSV. |

[[File:Pay_Day_Filing_Employment_Information.png|800px]] | [[File:Pay_Day_Filing_Employment_Information.png|800px]] | ||

Revision as of 03:02, 26 March 2019

Contents

About

Pay Day filing is a requirement by the IRD NZ - to see more information about it click on the following link.

PinvoiceR currently supports Pay Day filing through File Upload. In time we will be offering Pay Day Filing through Gateway Services.

How to use

From the main toolbar, click on the Payroll and Pay Day Filing links.

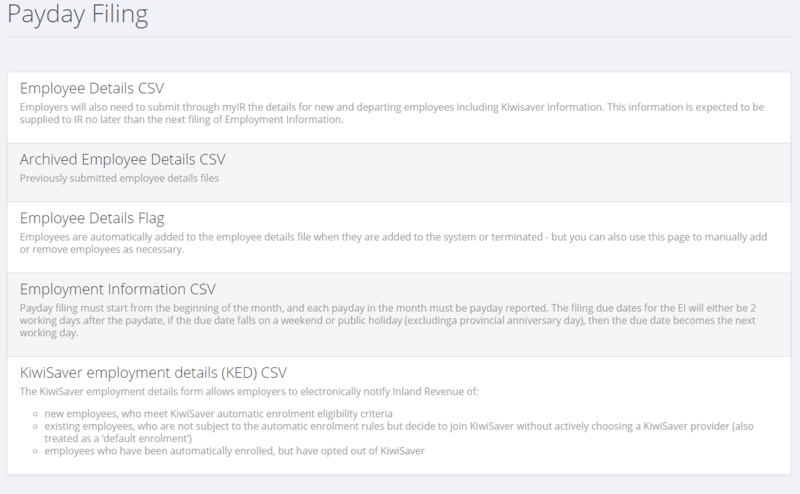

Employee Details CSV

Employers will also need to submit through myIR the details for new and departing employees including KiwiSaver information. This information is expected to be supplied to IR no later than the next filing of Employment Information.

To use, select the entity (eg if you have more than one entity) - then a list of employee details will show. Click on the Download button to create the CSV file.

Archived Employee Details CSV

This shows previously submitted employee details files and gives the option to download the csv again.

Employee Details Flag

Employees are automatically added to the employee details file when they are added to the system or terminated - but you can also use this page to manually add or remove employees as necessary.

Employment Information CSV

Payday filing must start from the beginning of the month, and each payday in the month must be payday reported. The filing due dates for the EI will either be 2 working days after the paydate, if the due date falls on a weekend or public holiday (excluding a provincial anniversary day), then the due date becomes the next working day.

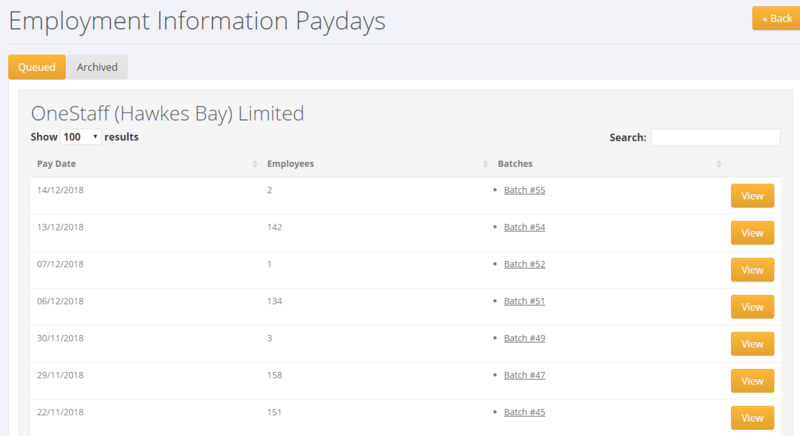

The batches not previously submitted will show on the Queued tab. Ones that have been previously submitted are on the Archived tab.

Click on the View button to see the detail of the batch(es) and then click on the Download button to download the CSV.

KiwiSaver employment details (KED) CSV

The KiwiSaver employment details form allows employers to electronically notify Inland Revenue of:

- New employees, who meet KiwiSaver automatic enrolment eligibility criteria

- Existing employees, who are not subject to the automatic enrolment rules but decide to join KiwiSaver without actively choosing a KiwiSaver provider (also treated as a ‘default enrolment’)

- Employees who have been automatically enrolled, but have opted out of KiwiSaver